Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

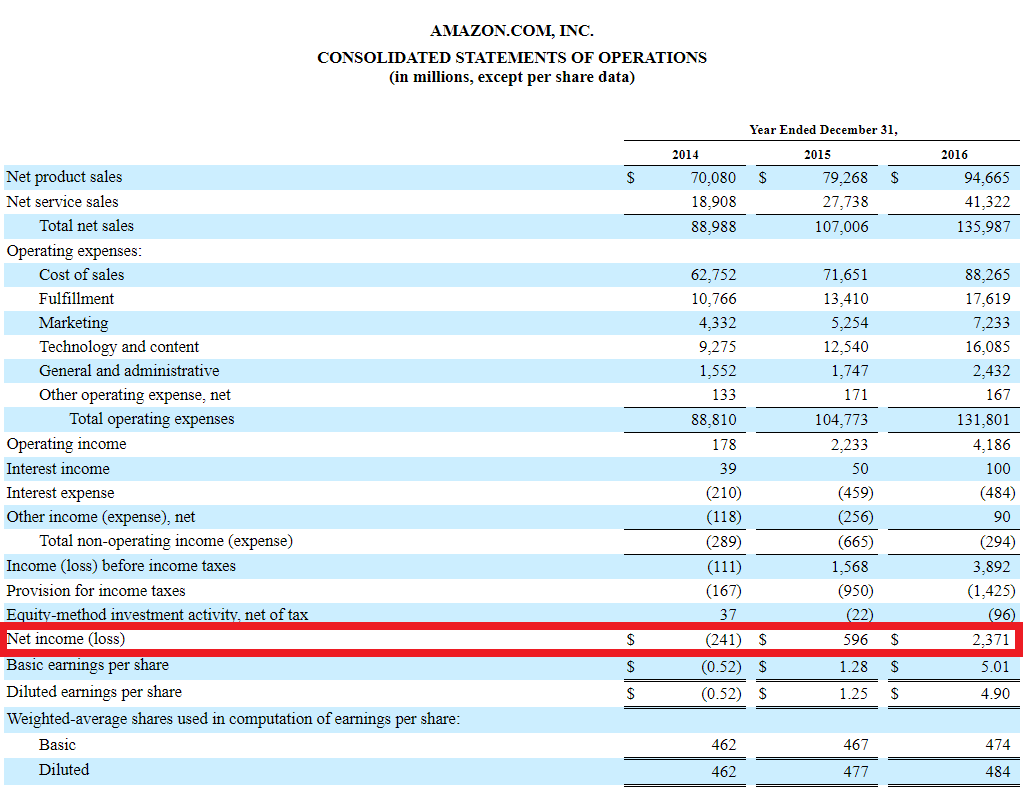

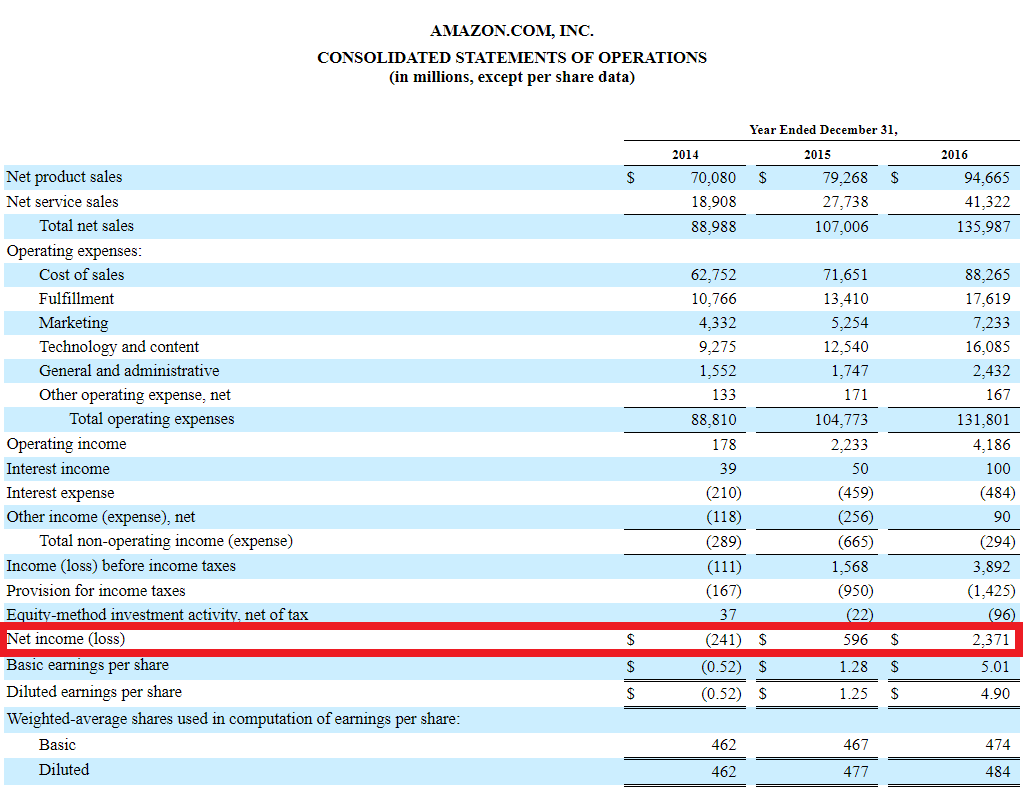

Net income is the amount of accounting profit a company has left over after paying off all its expenses. It is found by taking sales revenue and subtracting COGS, SG&A, depreciation and amortization, interest expense, taxes, and any other expenses.

Net income is the last line item on the income statement proper. Some income statements, however, will have a separate section at the bottom reconciling beginning retained earnings with ending retained earnings, through net income and dividends.

The bottom line of a company’s income statement has three commonly used names, which include:

All three of these terms mean the same thing, which can sometimes be confusing for people who are new to finance and accounting.

In this article, we use all three terms interchangeably.

Enter your name and email in the form below and download the free template now!

Download the free Excel template now to advance your finance knowledge!

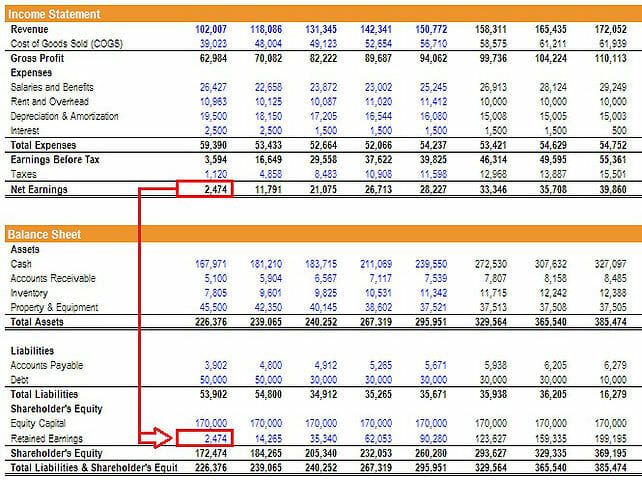

The net income is very important in that it is a central line item to all three financial statements. While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement.

Net income flows into the balance sheet through retained earnings, an equity account. This is the formula for finding ending retained earnings:

Ending RE = Beginning RE + Net Income – Dividends

Assuming there are no dividends, the change in retained earnings between periods should equal the net earnings in those periods. If there is no mention of dividends in the financial statements, but the change in retained earnings does not equal net profit, then it’s safe to assume that the difference was paid out in dividends.

In the cash flow statement, net earnings are used to calculate operating cash flows using the indirect method. Here, the cash flow statement starts with net earnings and adds back any non-cash expenses that were deducted in the income statement. From there, the change in net working capital is added to find cash flow from operations.

sheet through retained earnings" width="708" height="529" />

sheet through retained earnings" width="708" height="529" />

Net earnings are also used to determine the net profit margin. This is a handy measure of how profitable the company is on a percentage basis, when compared to its past self or to other companies.

Net profit margin is also used in the DuPont method for decomposing return on equity – ROE. The basic DuPont formula splits ROE out into three components:

ROE = Net Profit Margin x Total Asset Turnover x Financial Leverage

Analyzing a company’s ROE through this method allows the analyst to determine the company’s operational strategy. A company with high ROE due to high net profit margins, for example, can be said to operate a product differentiation strategy.

Net income is an accounting metric and does not represent the economic profit or cash flow of a business.

Since net profit includes a variety of non-cash expenses such as depreciation, amortization, stock-based compensation, etc., it is not equal to the amount of cash flow a company produced during the period.

For this reason, financial analysts go to great lengths to undo all of the accounting principles and arrive at cash flow for valuing a company.

Thank you for reading CFI’s guide to Net Income. The CFI resources below are designed to give you the tools and training you need to become a great financial analyst:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.